Share This Article

If you have an online business, it is necessary to configure different payment methods that make transactions easier for your customers and avoid losing sales for this reason.

The payment options for your ecommerce

If you request a payment through bank transfer, the customer must leave your ecommerce to go onto their banking website and enter information to carry this out. Adding these intermediate steps, it is possible that someone makes a purchase in your business, but then they never complete this transaction, so it turns into a lost sale.

Another option when it comes to receiving payments is by credit card. In this case the customer needs to have both their credit card and mobile phone nearby. Firstly, they will have to enter the card number and then they will receive a security SMS from their bank with a code they will need to enter to complete the purchase. Although it is easier than the bank transfer option, there is also the chance of losing the purchase due to the intermediate steps. What happens if your customer doesn’t have their bank card or telephone to hand?

Bear in mind that many online purchases are made on impulse, because we have been able to generate a need in the customer to buy at a specific moment, if we delay this time, we can lose the purchase.

Here is where PayPal comes in.

What is PayPal?

PayPal is one of the largest internet payment companies in the world and is a secure method of payment, both for the buyer and the seller. The customer only needs to enter their email address and password to make the purchase. With this type of transaction, PayPal does not have access to the private financial information of either of the parties of the transaction.

Have you heard of Elon Musk? Yes, the founder of Tesla…. Well, Elon Musk was also behind the birth of PayPal in 1988, in 2002 the company was bought by eBay, when this was already the method used by more than 50% of users on the platform.

In 2017, PayPal had profits of 1,795 million dollars and each of its shares were listed for more than 55 dollars. Its stock market value was more than 98,200 million dollars in October 2018.

Types of payment on PayPal

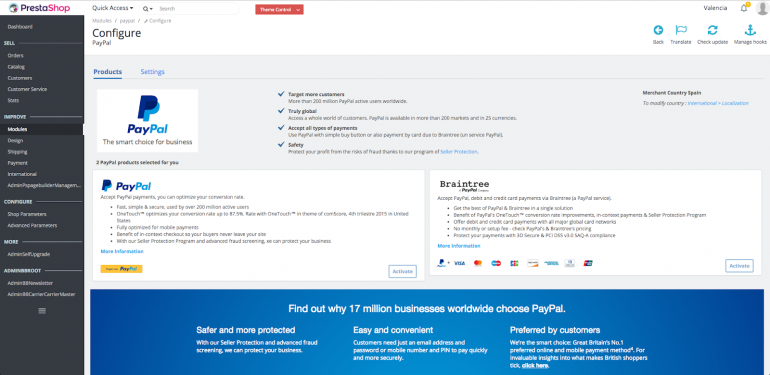

Standard payment

The basic PayPal system, compatible with practically all shopping baskets and free of charge. The buyer makes the payment and you receive the money in your account.

Professional payment

This enables you to create a customised payment page, so that customers don’t feel they are leaving your website to pay and it also facilitates mobile phone payments.

What else should you know?

You should bear in mind that PayPal charges you a commission for each transaction (variable between 1.9% and 3.4% + €0.35), so that this doesn’t impact on your profit margin you can increase the prices of your products by 2%, bearing in mind that most of your customers will use PayPal, you will be covering part of this commission.

Did you know that the entire BigBuy catalogue is translated into 24 languages? Well, PayPal also accepts payment in 26 different currencies so that borders don’t impose limits on your sales and you can design a cross border strategy for your business.

For all of these reasons, you must not forget to configure your PayPal account when your business synchronises with BigBuy. Don’t miss out on a single sale by adding unnecessary steps to the buying process, configure your account and you will soon see that most of your orders come by this payment method, thereby increasing your conversion rate.

Contact

Contact