At BigBuy we want to make the invoicing process easier for you when exporting outside the European Union, both on a theoretical and practical level. So that you know exactly how to create invoices for this type of export, in this post we will explain, step by step, how to create one, as well as some details and notes that may be very useful for you.

Important! Due to the customs regulations for exports outside the 28 Member States that make up the European Union (including Andorra and the Spanish regions of the Canary Islands, Ceuta and Melilla), it is necessary that you send us the sales invoice that you have issued to your customer in order to process this order; remember that when it is exported, the invoice must be EXEMPT from VAT or other taxes*.

*If shipments are between Norway and Norway, Norwegian tax may apply.

*If shipments are between Switzerland and Switzerland, Swiss tax may apply.

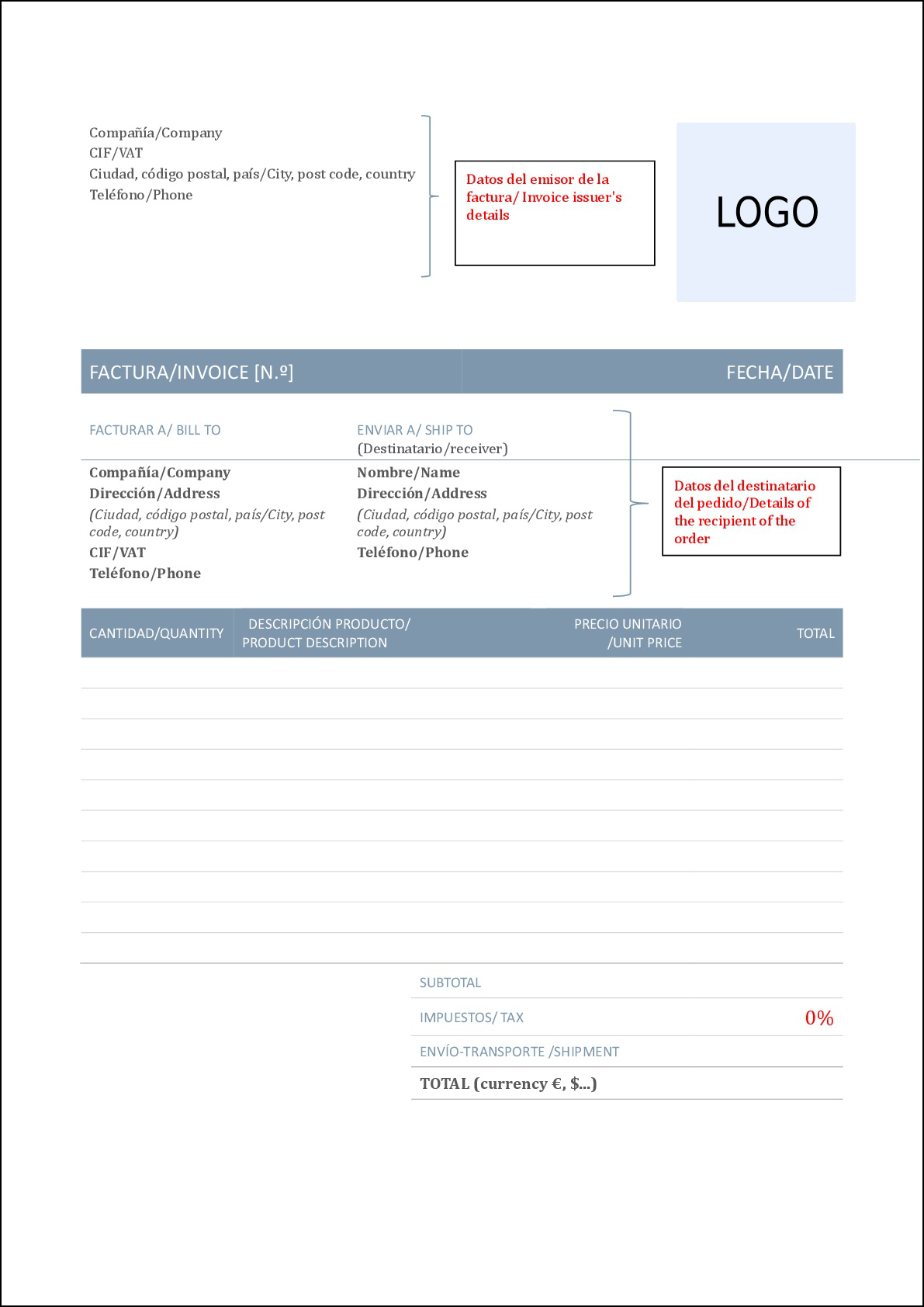

Below is a sample invoice with all the necessary fields, explained below.

The following information must appear on the invoice:

- Exporter information (either your company or yours, shown in in the upper left corner of the example): name, address, town, city, postal code, country and, very importantly, the NIF/CIF/VAT.

- Recipient information (your customer, which appears under “Send to” in the example): name, address, telephone number, town, city, postcode and country. If your customer is a company you can include the company information in the invoice under “Invoice to”.

- It is important that you indicate the taxes which have been applied, usually 0% and the currency of the invoice.

Remember that for dropshipping orders, the total amount of your sales invoice must be higher than the total amount of the order.

For consignments to the Canary Islands, the words ‘T2LF- Mercancía sin declaración’ must also appear on the invoice and the recipient ID number (or Passport).

Contact

Contact